One Stop-Shop (OSS) 2021 – A single declaration for all EU member states

New One-Stop Shop schemes

What is the One-Stop Shop (OSS)

The One Stop-Shop is the evolution of the Mini One Stop-Shop previously created in the EU to help companies providing telecommunication services, television and radio broadcasting services as well as electronically supplied services to non-taxable persons in member states.

The new and improved One-Stop Shop also covers the sales of B2C goods between EU member states, this way simplifying VAT Compliance for online sellers and electronic marketplaces.

Who will benefit from the One-Stop Shop OSS?

- All EU sellers who surpass the 10.000 € threshold in long distance sales to EU member states (not including their country of establishment), should opt to register for the One-Stop Shop (OSS)

- Sellers established in EU member states can use the OSS to declare sales of B2C services and distance sales of goods

- Sellers not established in the EU for distance sales of goods within the EU

- Online marketplaces who facilitate supplies of goods within the EU.

GVC can help you register for the OSS

Global VAT Compliance can register your business for the OSS and help you simplify your VAT reporting. Contact us now and one of our experts will be with you shortly in order to offer you a first assessment of your situation.

Why was the OSS created

The One stop shop was created in order to offer a simplification in VAT compliance businesses selling their products and services to EU consumers.

- Registration only in one member state for all intra-EU distance sales of goods and B2C services.

- Only a single VAT return has to be declared for all EU sales as well as a single payment for all sales.

- Companies only have to communicate with one tax authority in one only member state where they are registered for the OSS.

Is there more than one OSS?

Yes! There are three One-Stop Shop schemes. The Non Union Scheme for providers of services, the Union Scheme for B2C supplies of services and goods in the EU and the Import scheme or Import One Stop Shop for sellers established outside the EU.

Non union scheme

The Non union scheme is a continuation of the mini one stop shop for non EU sellers of services.

In this scheme non union sellers of services to EU consumers can register in order to declare VAT for their services offered in all EU states.

Union Scheme

This scheme is also known just as the OSS which we covered above and it is designed for sellers located in the EU who sell their products or services to EU member states.

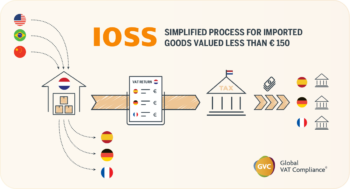

Import Scheme (Import One-Stop Shop)

The import scheme is known as the Import One Stop Shop IOSS and it is focused towards sellers located outside the EU selling products of a value less than 150 € in EU member states.

Special arrangements

In this case no VAT is charged at the moment of sale but the buyer has to pay vat to the postal or courier operator for the collection of the products. These special arrangements were introduced in the case where the seller opts not to use the IOSS when selling products to an EU Member State from a third country.