IOSS (Import One-Stop Shop) Scheme. Ecommerce VAT Changes 2021

What is the IOSS?

Simply put the IOSS (Import One-Stop Shop) is the electronic portal businesses can use from 1 July 2021 to comply with their VAT e-commerce obligations on distance sales of imported goods. The IOSS allows suppliers and electronic interfaces (online marketplaces e.g. Amazon) selling imported goods to buyers in the EU to collect, declare and pay the VAT to the tax authorities, instead of making the buyer pay the VAT at the moment the goods are imported.

Why is the IOSS introduced?

Both new schemes OSS and IOSS will help in Simplifying the VAT invoicing process while at the same time combating VAT fraud.

This ensures fair competition for EU companies and the EU consumers will appreciate knowing that when buying goods online from outside or inside the EU, the VAT rate will be applied for the same as for goods acquired in their home country.

Many changes came in effect this July for VAT and e-commerce, as a result all sellers need to be prepared accordingly in order to reduce any impact on their businesses. We already analysed in our previous article the new One-Stop Shop scheme that will take place or rather its expansion from the previous Mini One-Stop Shop (MOSS) that was in place.

Up until now the European union operated with the low-value consignment relief in place which meant that no import VAT had to be paid for all goods that enter the European territory of a value up to 22€.

This rule changed in July 2021 and every consignment that enters the EU from a third country is liable for import VAT. This is also one of the reasons why the Import One Stop Shop was introduced.

Do I need IOSS?

GVC created a free tool with which you can receive your first VAT assessment for the IOSS and OSS. Click below to receive your free assessment!

How does the IOSS work?

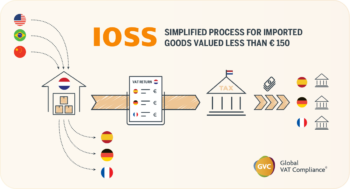

The IOSS will be used for the importation of goods valued less than EUR 150 and it will simplify the declaration as well as payment of VAT of goods sold by distance sellers or electronic marketplace facilitating sales of goods.

When registering to the IOSS, online sellers or online marketplaces/platforms receive an IOSS VAT number. This IOSS VAT number is used by postal operators and courier services to declare goods upon importation to the customs authorities. They can do so in any Member State regardless of the destination of the goods. Customs authorities verify the validity of the IOSS VAT number and then the package can be delivered to the customer.

If a consignment consists of more than one item the total number of goods is being taken under consideration as the value of the consignment. The IOSS does not cover sales of goods that are subject to excise duties.

Since April 2021, you can register on the IOSS portal of any EU Member State. If businesses are not based in the EU, they will normally need to appoint an EU-established intermediary to fulfil their VAT obligations under IOSS.

Global VAT Compliance can help you with your VAT obligations so you can focus on your expanding business. Click here to view our IOSS / OSS Solutions

Do companies receive their own IOSS number separate from the IOSS Intermediary?

Yes the IOSS intermediary has a unique number that is used for customs but each IOSS (Import One-Stop Shop) registrant who registers via the IOSS intermediary will also receive a personal IOSS number.

You do not need to charge VAT on sales if:

- The consignment is more than 150 EUR as these goods will be taxed at importation in the EU member state of import.

- Your sales are facilitated by an electronic marketplace that is a deemed supplier. In this case the marketplace needs to collect and remit VAT.

Last updated: 27/07/2021