G20 agrees with the OECD’s global tax reform

The tax landscape will change as G20 countries agree to the OECD’s proposal for taxing the digital economy and to the 15% minimum global corporate tax rate.

Following the meeting on 10th July, the world’s 20 largest economies (G-20) approved the proposal by the OECD (the Organization for Economic Co-operation and Development) for taxing a digital economy and setting a minimum global corporate tax rate at 15% in 2023.

The new framework proposed by the OECD is designed to prevent large multinationals from avoiding paying tax through base erosion and profit shifting (BEPS). It outlines that taxing rights should be determined by the place where the goods and services are being purchased by customers, rather than where the company is physically based. The proposal also sets a new global corporate tax rate at the minimum of 15% for companies with a turnover of more than €750 million.

The proposal if finalized in October 2021 as planned, would be implemented in 2023.

What is BEPS?

BEPS (base erosion and profit shifting) refers to tax planning strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity or to erode tax bases through deductible payments such as interest or royalties. Although some of the schemes used are illegal, most are not.

This undermines the fairness and integrity of tax systems because businesses that operate across borders can use BEPS to gain a competitive advantage over enterprises that operate at a domestic level. Moreover, when taxpayers see multinational corporations legally avoiding income tax, it undermines voluntary compliance by all taxpayers.

It is estimated that close to 40% of multinational profits were artificially shifted to tax havens in 2015.

The EU and the developing countries are among those most affected by BEPS

According to the OECD, large multinationals could have deprived countries of 100 billion USD to 240 billion USD of global corporate income taxes each year by taking advantage of unilateral tax rates across the world.

OECD outlines that BEPS is of major significance for developing countries due to their heavy reliance on corporate income tax, particularly from multinational enterprises. Engaging developing countries in the international tax agenda is important to ensure that they receive support to address their specific needs and can effectively participate in the process of standard-setting on international tax. However, the research by University of Copenhagen and UC Berkley shows that it is the European Union that looses the most from shifted profits whereas the developing countries place the second in in terms of loss.

The Inclusive Framework on BEPS Package: the global tax reform by OECD and G20

The joint global tax reform by the OECD and G20 is aimed at ensuring a fairer distribution of profits and taxing rights among countries with respect to the MNEs (Multinational Enterprises) and to bring much needed tax certainty and stability to the international tax system.

To address tax challenges caused by a digital economy the OECD developed an Inclusive Framework on BEPS Package, a two-pillar package expected to bring in a tax revenue of approximately 250 billion USD per year.

- Pillar 1

Pillar 1 is based on changing corporate tax rules whereby taxing rights are determined by the place where the goods and services are being purchased by customers and not by where company’s headquarters are based. Following the implementation of Pilar 1, about $100 billion of profits are expected to be re-distributed.

In-scope of Pilar 1 are the multinational enterprises (MNEs) with a global turnover of more than €20 billion and a profit margin of more than 10%, 20-30% of the part of the profits exceeding 10% (i.e. excess profits) would be taxed in the countries where the company made its sales.

However, the OECD outlines the possibility that the turnover threshold could be lowered from €20 billion to €10 billion after an initial seven-year trial period.

- Pillar 2

Pilar 2 proposes a global minimum corporate tax of at least 15% for companies with a turnover of more than €750 million. Following the implementation of Pilar 2, about $150 billion of profits are expected to be re-distributed.

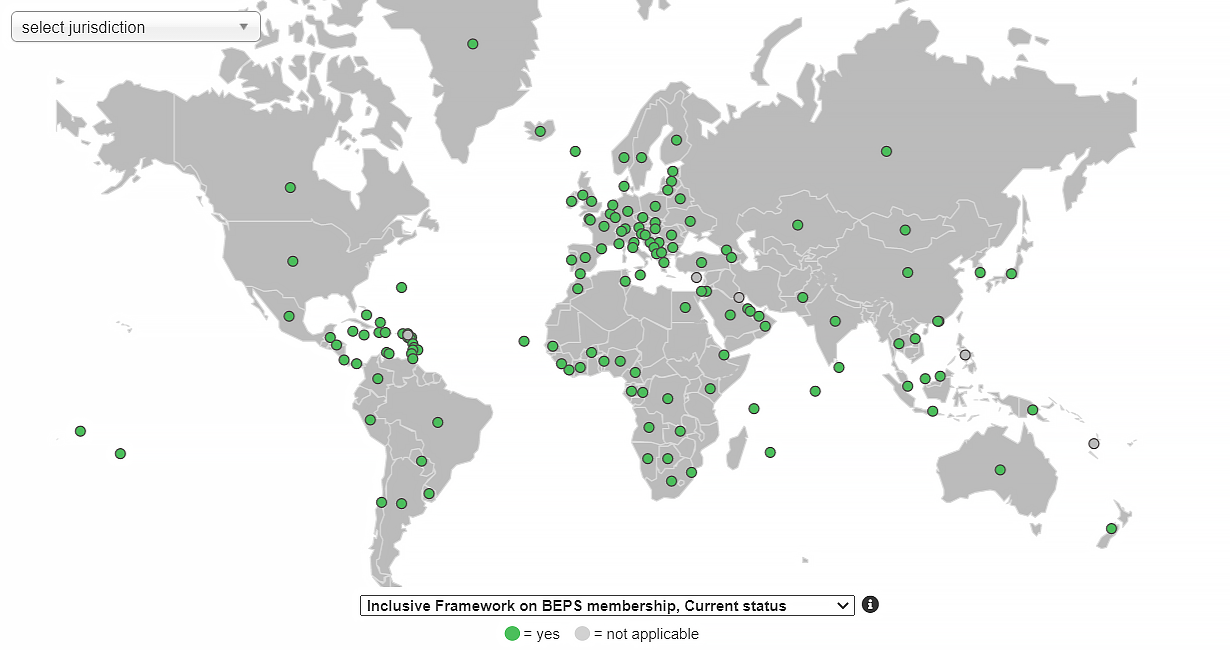

Inclusive Framework on BEPS Membership

This map sourced from the website of OECD 21st July 2021, shows over 135 countries that became the members of the Inclusive Framework on BEPS, committed to collaborate on the implementation of the OECD/G20 BEPS Package.

Does the Inclusive Framework on BEPS mean that other tax-rules on digital services will be eliminated?

According to the report by the OECD, upon implementation, Pillar 1 will provide for appropriate coordination between the application of the new international tax rules and the removal of all Digital Service Taxes and other relevant similar measures on all companies.

How would tax compliance be affected by OECD’s Inclusive Framework on BEPS?

The tax compliance will be streamlined (including filing obligations) and allow MNEs to manage the process through a single entity.

When will the joint global tax-reform by OECD and G20 be implemented?

The implementation of a plan including both of the pillars is planned for the year 2023.

How are decisions taken on the Inclusive Framework on BEPS ?

The reform has been initially approved by 131 countries after meetings in July held by G20 and OECD. If OECD’s proposal is finalized in October 2021 as planned, it would need parliamentary approval in more than 130 countries including the U.S. and all of the EU member states; and be implemented in 2023.

Source: OECD website, OECD Secretary General Tax Report to G20 Finance Ministers, The Missing Profits of Nations article