EU – IOSS intermediary

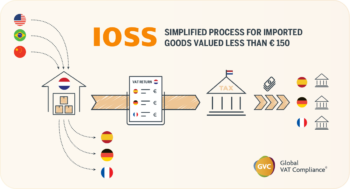

To ensure a smooth transition to the new VAT system, the EU has created the Import One-Stop Shop (IOSS). The IOSS is the electronic portal businesses can use from the 1st of July 2021 to comply with their VAT ecommerce obligations on importing commercial goods from outside the EU.

IOSS intermediary

From April 1st IOSS registrations are open and businesses can register on the IOSS portal of any EU member state. All EU businesses can register for the IOSS. For businesses outside the EU an IOSS intermediary will need to be appointed in order to register those businesses under IOSS. This intermediary can only be a company established in the EU.

The IOSS registration is valid for all distance sales of imported goods to buyers in the EU. You can start using the IOSS only for the goods sold as from 1 July 2021.

GVC can register your company for the IOSS. Contact us now to assess your company’s requirements and get the most of the Import one-stop shop.

This IOSS intermediary is acting on behalf of its clients in order to perform all VAT payments to the tax authorities. As such, the IOSS intermediary is jointly liable to the EU tax authorities regarding their clients VAT obligations. IOSS does not require the intermediary to take care of the suppliers customs declarations.

This IOSS registration is valid for all distance sales of imported goods of value under 150€ to buyers in the EU. IOSS will be available for all goods sold starting July 1st 2021 and after.

Do you need an intermediary for IOSS?

If your company is not located in the EU then you can only register to the IOSS through an IOSS intermediary. This Intermediary is also liable for any VAT owed by the seller.

Register now for the IOSS

If you require an IOSS intermediary GVC can register your business for the IOSS and you can benefit from selling into all 27 EU countries with one VAT registration.

Benefits of IOSS:

- With the IOSS you only need one VAT registration to one EU member state.

- With the Import One Stop Shop (IOSS) you only report your sales in a unified VAT return to one Tax Authority.

- You reduce administration costs as you no longer have to deal with many Tax Authorities file separate VAT returns.

- Your products are not held at customs waiting for the recipient to pay import taxes.

- Customer pays VAT at checkout therefore there are no extra costs when receiving the products.

Learn more about IOSS

Download our comprehensive IOSS guide for online sellers. Learn more about the new EU VAT rules, the benefits of IOSS as well as our dedicated solution for automating your VAT returns.

Is there an IOSS number for each seller?

Yes. When registering for the IOSS, the IOSS intermediary will receive a unique number appointed to the intermediary to use with customs processes. When the IOSS intermediary registers the seller they represent, then in turn the seller will also receive a new unique IOSS number.

Is the IOSS compulsory?

No the Import One-Stop Shop as well as the One-Stop Shop are both optional schemes but if you need an IOSS registration and you are based outside the EU then you will require an IOSS intermediary.

Learn all about the (IOSS) Import One-Stop Shop (Video):

Global VAT Compliance offers a comprehensive FAQ section on the IOSS. Are you interested to learn more about IOSS?

See what our customers have been asking on the most frequently asked IOSS questions. Click here to view our IOSS FAQ

Need further assistance? Use the form below to directly contact one of our VAT experts.

Interested in IOSS? Contact GVC

Updated 20/10/2021

Source: ec.europa.eu