Streamline Your VAT Process: Register for OSS & IOSS Now

The One-Stop-Shop (OSS) and the Import One-Stop-Shop (IOSS) are VAT schemes introduced in July 2021 by the European Union. They revolutionize the way VAT is collected on cross-border transactions, simplifying obligations for businesses selling goods or services across EU borders.

OSS allows EU-based businesses to report and pay VAT from multiple EU member states in one consolidated return.

IOSS facilitates the collection, declaration, and payment of VAT for sellers on distance sales of imported goods up to €150, streamlining e-commerce operations. These schemes aim to create a more efficient VAT system, reducing burdens for businesses and fostering intra-EU trade.

Our end-to-end OSS and IOSS registration services ensure your business meets all EU requirements seamlessly. Let GVC guide you through the registration process to guarantee your compliance and efficiency.

Do you require IOSS or OSS? Use our online free tool to assess your situation. Click here

The VAT e-Commerce package

The EU VAT e-Commerce package, which included new rules regarding VAT compliance in the EU, came into effect in July 2021.

These rules had an immediate impact on all businesses in the supply chain, including individual sellers and marketplaces. All distance sellers within the EU or trading with the EU now need to redefine their VAT requirements.

GVC offers a variety of services in relation to the new EU VAT rules.

What changed after July 1st 2021?

The changes that took place after July are:

- Removing the distance selling thresholds for sales of goods and setting a unified threshold of 10.000 euro

- Expanding the Mini One Stop Shop (MOSS) by Launching the new One Stop Shop (OSS)

- Ending the low-value import VAT exemption and introducing the new IOSS

- Online marketplaces are deemed the seller for collecting and reporting VAT

- New record-keeping requirements are introduced for online marketplaces facilitating supplies of goods and services

- Special arrangements were introduced in order to simplify imported goods with a value of less than €150 in case the IOSS (import one-stop-shop) is not used

Register for IOSS & OSS with GVC Click Here

Why were these new e-Commerce VAT rules introduced?

Simplification

The VAT thresholds set by each country used to cause an enormous administrative burden for sellers and governmental organizations. The unified threshold aims to simplify the process of VAT reporting as one threshold of €10,000 will be used for all EU members.

At the same time, the adoption of the new One Stop Shop (OSS) will help businesses register for VAT in only one Member State from which they can report VAT for all of their EU sales combined.

Fairness

The new rules should help a lot in reducing VAT fraud and in making the environment fairer for EU businesses to sell their products in the EU territory. This means that EU businesses will be able to compete on equal footing with non-EU businesses that are currently not charging VAT.

Revenue

It is predicted that Member States will gain an increase in VAT revenues of EUR 7 billion annually

OSS & IOSS – Sellers checklist

In this short video, we offer an OSS checklist for sellers as well as our insight on what sellers need to consider after the EU VAT changes took place. This is part of our OSS webinar. You can view the full video by clicking here

Who is affected by the changes

All B2C sales within and towards the EU domain were affected by the VAT e-Commerce changes in July. Of course, all sellers are affected but also every aspect of the supply chain was impacted as well such as postal operators, couriers and customs offices. Consumers also started to feel the impact of these changes as they saw an increase in prices from imported items and in some cases VAT will have to be paid by the consumer directly to the courier or postal operator for delivery of low value consignments imported from outside the EU.

Affected by these changes?

eCommerce VAT changes in detail:

Distance selling thresholds

As we mentioned above, all distance selling thresholds were removed and only one threshold is now in place of €10.000 which takes into consideration all sales within the EU territory excluding the seller’s country of establishment.

In the past, each country had a different VAT threshold, which made things more complicated for sellers and government organizations.

For example, France had a VAT registration threshold of €85,800 while Germany had a €22,000 threshold.

Global VAT Compliance offers a variety of services in regards to OSS and the upcoming changes. Click here

The One Stop Shop (OSS)

One of the biggest changes that took take place in July is the expansion of the Mini One Stop Shop to the new One Stop Shop (OSS) for goods and services. This expansion extends the use of the MOSS to all B2C services and distance sales of goods within the EU and to certain domestic supplies of goods facilitated by online marketplaces (OMP’s)

- After July 2021, businesses selling goods and services within the EU can benefit from registering VAT in only one member state instead of having to register in each country where goods or services are offered.

- Businesses can now exchange information with only one Tax Authority of the Member State in which they have registered and in only one language.

- At the same time, they only need to file a single VAT declaration and payment for all the goods and services offered in EU Member States.

- Registering for the OSS is not obligatory but it is therefore very attractive because all VAT obligations for distance sales throughout the EU are met via one central declaration.

Registering for the OSS is only possible for EU entrepreneurs in the EU country of residence. If you are located outside the EU, you can choose the Member State of registration yourself but you will require an OSS or IOSS intermediary. The country from which you ship goods to consumers may be the best choice.

Click here to download our OSS guide.

Global VAT Compliance can help you register for the OSS and take care of all of your VAT obligations so you can focus on your expanding business. Avoid any delays and reduce the impact of the e-Commerce changes by having a qualified VAT expert assess your situation.

The Import One stop shop (IOSS)

As mentioned above, the €22 low value consignment relief for consignments entering the EU is now abolished. As a result, every consignment that enters the EU from a third country is now liable for import VAT.

For this reason, the new Import One Stop Shop (IOSS) was introduced.

What is the IOSS?

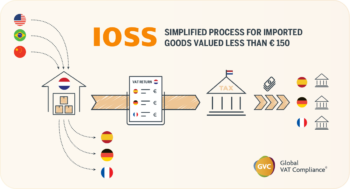

The Import One Stop Shop is a portal similar to the OSS where businesses can register in order to comply with their VAT obligations on distance sales of imported goods to the EU. The IOSS is available since July 1st 2021 and it allows suppliers and electronic interfaces selling imported goods to buyers in the EU to collect, declare and remit VAT to the tax authorities instead of making the buyer pay the VAT at the moment the goods are imported.

Why was the Import One Stop Shop being Introduced?

Both schemes OSS and IOSS had a two-fold purpose. They help combat VAT fraud in the EU while at the same time simplifying the process of collecting and declaring VAT by companies. This will ensure fair competition for EU companies and at the same time, EU consumers will appreciate knowing that when buying goods online from outside or inside the EU, the VAT rate will be the same as for goods acquired in their home country.

How does the IOSS work?

The IOSS is used by companies who import goods valued less than EUR 150 and it can simplify their VAT declaration as well as payment of VAT for the goods sold by distance sellers or electronic marketplaces who facilitate sales of goods.

Once registered, businesses will receive an IOSS VAT number which can be used by postal operators and courier services for importation of the goods through customs. Customs authorities will verify the number’s validity and the package will then move on to its final destination. This will be valid for all EU Member States.

The total value of the consignment will be taken under consideration even if the consignment consists of more than one item. Goods subject to excise duties (such as liquor and cigarettes) and used goods (such as refurbished phones or laptops) are not covered by the IOSS.

Registrations for the IOSS are open since April 1st for all EU member states. If a seller is not EU based then an IOSS EU intermediary will need to be appointed in order to fulfil the seller’s VAT obligations under OSS.

Click here to download our IOSS guide.

VAT / GST Consultancy

Is your business involved in eCommerce? Are you a digital service provider? Our VAT advisors are ready to offer you in-depth bespoke VAT consultancy services for your company.

We can offer you VAT consultancy on OSS & IOSS, Digital Services, Cryptocurrency, Brexit and everything related to your VAT / GST compliance.

Please note this service involves a fee. Should you wish to have an introductory call regarding our services please click here.

Online marketplaces (OMP’s)

Online marketplaces that facilitate distance B2C transactions may be required to collect and account for VAT on these sales as they will be deemed supplier of the goods.

VAT is collected by the marketplace when the sale takes place and is reported in the new online systems Import One Stop Shop (IOSS) and One Stop Shop (OSS).

Marketplace sellers still require to obtain EU VAT registrations in each country where their goods are stored.

When is an online marketplace considered to be a deemed supplier?

A marketplace is a deemed supplier if it facilitates:

- Distance sales of goods imported to the EU with a value not exceeding EUR 150; or

- If it facilitates intracommunity distance sales of goods to customers in the EU, irrespective of their value, when the underlying supplier/seller is not established in the EU (both domestic supplies and distance sales within the EU are covered).

When is an online marketplace not a deemed supplier?

- A marketplace cannot be considered to be a deemed supplier if it sells goods in consignments whose value is over €150 imported in the EU irrespective of where the actual supplier is established in the EU

- Also it cannot be considered to be a deemed supplier if the goods are supplied to EU customers (irrespective of value) and the underlying supplier is established in the EU.

Online marketplaces – New record keeping obligations

New record keeping obligations were also introduced for online marketplaces even if the marketplace is not considered to be a deemed supplier. Under the new rules, marketplaces still require to keep records of their transactions. These records should be kept for at least 10 years in order to be made available electronically to the EU member state authorities should they are requested.

Special arrangements scheme for sellers and marketplaces

If sellers have difficulties in collecting taxes during checkout or they do not want to register for the IOSS then they could opt for the special arrangements scheme. This is an alternative simplified way of collecting import VAT in case the IOSS is not used. This is applicable only for consignments below €150 and only if the EU country of destination of the goods is the same EU country of importation.

In this case, the seller does not charge VAT at the moment of sale but VAT is requested from the final recipient of the goods (buyer) by the company presenting the goods to customs. This company can be a courier company or postal carrier. VAT can be collected from the customer before delivery or at the moment of delivery. Different ways of collecting VAT from consumers exist and multiple applications are being developed in order to facilitate this collection procedure.

The scheme is designed for dropshipping businesses and is implemented by postal operators and express carriers in the EU who typically declare low value goods for importation.

As Tax Specialists, Global VAT Compliance can help you become compliant in every VAT related aspect of your business. Contact GVC for a VAT assessment and become ready for the upcoming changes.