Industry Solutions

DIGITAL SERVICES

Managing VAT compliance in today’s dynamic economic environment has become ever more challenging. As the digital economy continues to grow in an accelerated speed, governments across the world are rapidly introducing new tax measures in efforts to capture a resulting revenue.

The most common methods for taxing the digital services include the introduction of Digital Services Tax (DST) or the expansion of the Value Added Tax (VAT) and Goods and Services Tax (GST) indirect tax to the sale of digital services.

In the absence of multilateral rules that regulate taxing digital services world-wide, countries started to introduce their own rules. The DST or VAT/GST rules for digital services therefore, can differ significantly per country.

The most common differentiating factors include:

-

Place of supply rules

-

Tax Rates

-

Thresholds

-

VAT compliance deadlines

-

Administrative requirements

-

Number of users who use the service

-

Number of on-line business contracts related to the service

Multinational companies expanding their digital services to new markets are often unaware that they are taking on an increasing VAT compliance burden. Growing into new markets also means that multinationals often must confront the banking or technological limitations in the country of compliance, causing tax and finance departments to spend a disproportionate amount of time on compliance activities.

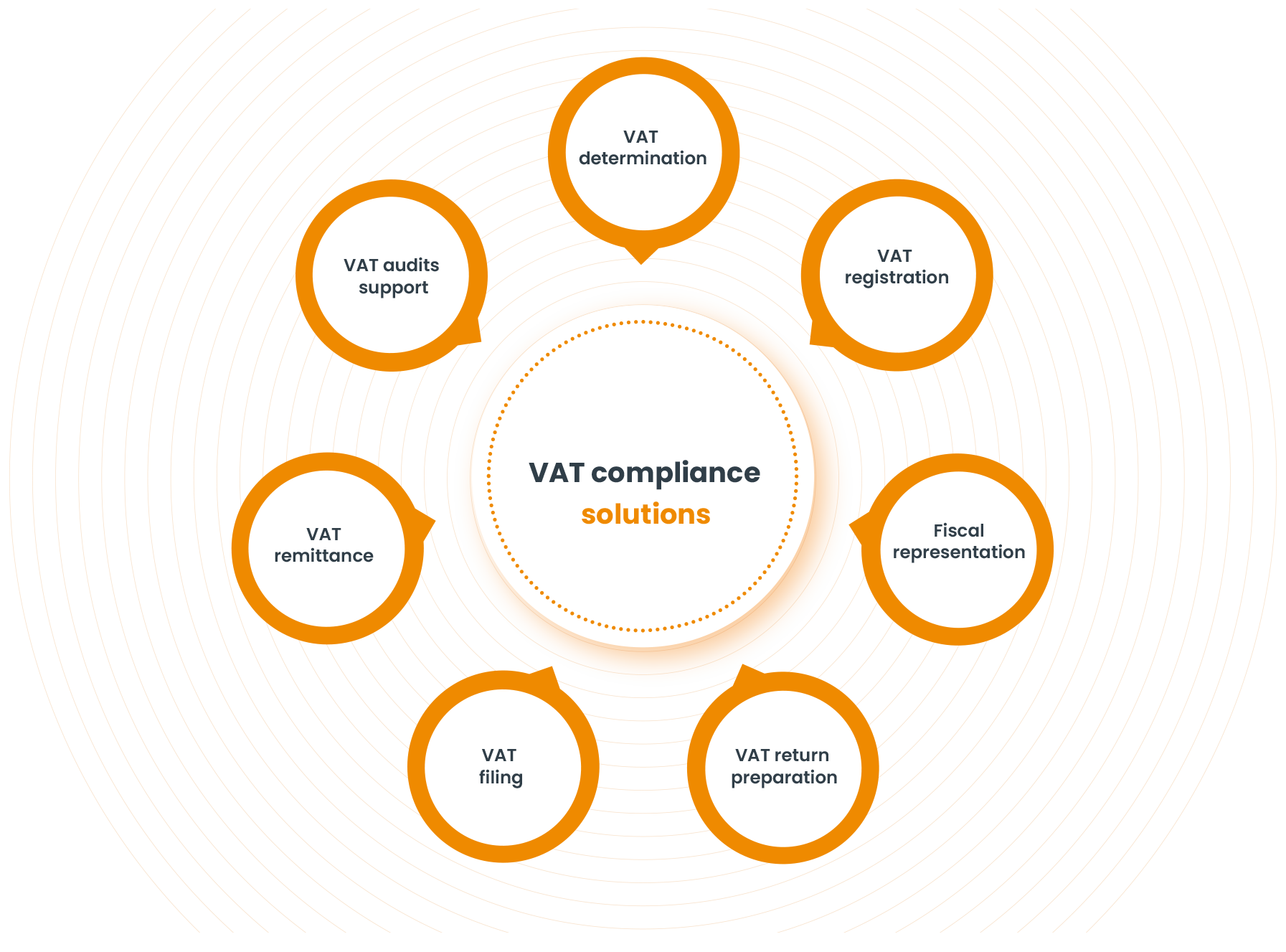

These challenges require solutions that help businesses comply with new VAT / GST obligations and grow.

GLOBAL VAT COMPLIANCE

Leading VAT Service Provider for International Businesses

We are Global VAT Compliance (GVC), a leading transaction tax compliance service provider with over a decade years of expertise in indirect taxation and tax advisory. We serve multinational companies with VAT compliance in over 90 countries worldwide.

View our video on how GVC can help your business.

A global coverage and a single point of contact model

Our VAT compliance services cover over 90 jurisdictions worldwide

All 27 EU Countries |

Bosnia & Herzegovina |

Ivory Coast |

Nigeria |

Taiwan |

Albania |

Cambodia |

Japan |

North Macedonia |

Thailand |

Andorra |

Canada* |

Kazakhstan |

Norway |

Turkey |

Angola |

Chile |

Kenya |

Oman |

Uganda |

Australia |

Colombia |

Korea |

Philippines |

Ukraine |

Azerbaijan |

Costa Rica |

Kosovo |

Russia |

United Arab Emirates |

Bahamas |

Ecuador |

Malaysia |

Saudi Arabia |

United Kingdom |

Bahrain |

Egypt |

Mauritius |

Senegal |

United States |

Bangladesh |

Georgia |

Mexico |

Serbia |

Uruguay |

Barbados |

Ghana |

Moldova |

Singapore |

Uzbekistan |

Belarus |

Iceland |

Morocco |

South Africa |

Vietnam |

Bermuda |

India |

Nepal |

South Korea |

Vietnam |

Bhutan |

Indonesia |

New Zealand |

Switzerland |

* British Columbia, Manitoba, Quebec, Saskatchewan

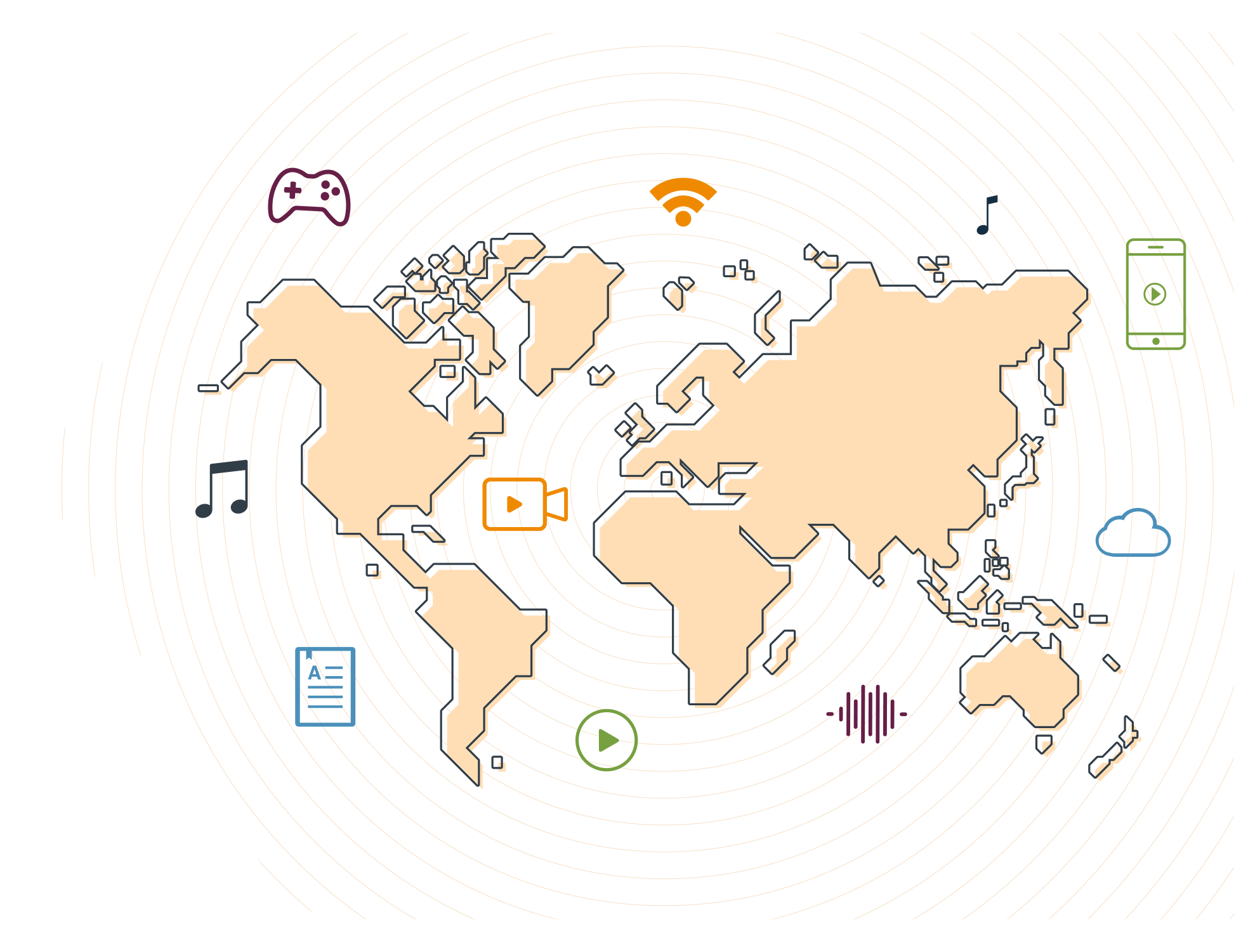

Most of Digital Service Markets we serve

|

|

|

|

SaaS |

Cloud Computing |

E-Publishing |

Cryptocurrency |

|

|

|

|

Music Streaming |

Video Streaming |

On-line Education |

Gaming |

Global VAT/GST Rates

VAT rates and thresholds for foreign providers of digital services across the world:

Country |

Tax Rate |

Type of Tax |

Type of VAT Collection |

Threshold |

Albania |

20% |

VAT |

E-services |

10 million ALL |

Andorra |

4,5% |

IGI |

Sales Tax |

40 000 EUR |

Angola |

14% |

VAT |

E-services |

– |

Australia |

10% |

GST |

E-services |

75,000 AUD |

Austria |

20% |

VAT |

E-services |

– |

Azerbaijan |

18% |

VAT |

E-services |

200,000 AZN |

Bahamas |

10% |

VAT |

E-services |

100,000 BSD |

Bahrain |

10% |

VAT |

E-services |

– |

Bangladesh |

15% |

VAT |

E-services |

8 million BDT |

Barbados |

22% |

VAT |

Mobile services |

200,000 BBD |

Barbados |

17.5% |

VAT |

E-services |

200,000 BBD |

Belarus |

20% |

VAT |

E-services |

– |

Belgium |

21% |

VAT |

E-services |

– |

Bhutan |

7% |

GST |

VAT / GST |

5 million BTN |

Bosnia & Herzegovina |

17% |

VAT |

E-services |

50,000 BAM |

Bulgaria |

20% |

VAT |

E-services |

– |

Bulgaria |

6% |

VAT |

E-book |

– |

Cambodia |

10% |

VAT |

E-services/e-commerce |

250 million KHR |

Canada – GST/HST |

5% |

GST/HST |

E-services/goods |

30,000 CAD |

Canada – British Columbia |

7% |

PST |

Sales tax |

10,000 CAD |

Canada – Manitoba |

7% |

RST(PST) |

E-services |

– |

Canada – Quebec |

9,975% |

QST |

E-services |

30,000 CAD |

Canada – Saskatchewan |

6% |

PST |

E-services |

– |

Chile |

19% |

VAT |

E-services |

– |

Colombia |

19% |

VAT |

E-services |

– |

Costa Rica |

13% |

VAT |

E-services |

– |

Croatia |

25% |

VAT |

E-services |

– |

Cyprus |

19% |

VAT |

E-services |

– |

Czechia |

21% |

VAT |

E-services |

– |

Denmark |

25% |

VAT |

E-services |

– |

Ecuador |

12% |

VAT |

E-services |

– |

Egypt |

14% |

EST |

E-services |

500,000 EGP |

Estonia |

20% |

VAT |

E-services |

– |

Finland |

24% |

VAT |

E-services |

– |

France |

20% |

VAT |

E-services |

– |

Georgia |

18% |

VAT |

E-services |

– |

Germany |

19% |

VAT |

E-services |

– |

Ghana |

12,5% |

VAT |

VAT / GST |

200,000 GHS |

Greece |

24% |

VAT |

E-services |

– |

Hungary |

27% |

VAT |

E-services |

– |

Iceland |

24% |

VAT |

E-services |

2 million ISK |

India |

18% |

GST |

E-services |

10 lakh INR |

Indonesia |

11% |

VAT |

E-services |

600 million IDR/12,000 visitors per year |

Ireland |

23% |

VAT |

VAT / GST |

– |

Italy |

22% |

VAT |

E-services |

– |

Japan |

10% |

Consumption Tax |

E-services |

10 million JPY |

Kazakhstan |

12% |

VAT |

E-services |

– |

Kenya |

16% |

VAT |

E-services |

– |

Kosovo |

18% |

VAT |

E-services |

– |

Latvia |

21% |

VAT |

E-services |

– |

Lithuania |

21% |

VAT |

E-services |

– |

Luxembourg |

17% |

VAT |

E-services |

– |

Malaysia |

6% |

VAT |

E-services |

500,000 MYR |

Malta |

18% |

VAT |

E-services |

– |

Mauritius |

15% |

VAT |

E-services |

10 million MUR |

Mexico |

16% |

VAT |

E-services |

– |

Moldova |

20% |

VAT |

E-services |

– |

Morocco |

20% |

VAT |

E-services |

– |

Netherlands |

21% |

VAT |

E-services |

– |

Netherlands |

9% |

VAT |

e-publications |

– |

New Zealand |

15% |

GST |

E-services |

60,000 NZD |

Nigeria |

7.5% |

VAT |

E-services |

25,000 USD |

Norway |

25% |

VAT |

E-services |

50,000 NOK |

Oman |

5% |

VAT |

E-services |

– |

Philippines |

12% |

VAT |

E-services |

3 million PHP |

Poland |

23% |

VAT |

E-services |

– |

Portugal |

23% |

VAT |

E-services |

– |

Romania |

19% |

VAT |

E-services |

– |

Russia |

20% |

VAT |

E-services |

– |

Saudi Arabia |

15% |

VAT |

E-services |

375,000 SAR |

Serbia |

20% |

VAT |

E-services |

– |

Singapore |

7% |

GST |

E-services |

1 million SGD |

Slovakia |

20% |

VAT |

E-services |

– |

Slovenia |

22% |

VAT |

E-services |

– |

South Africa |

15% |

VAT |

E-services |

1 million ZAR |

South Korea |

10% |

VAT |

E-services |

– |

Spain |

21% |

VAT |

E-services |

– |

Sweden |

25% |

VAT |

E-services |

– |

Switzerland |

7,7% |

VAT |

E-services |

100,000 CHF |

Taiwan |

5% |

VAT |

E-services |

480,000 NTD |

Tanzania – Mainland |

18% |

VAT |

E-services |

100 million TZS |

Tanzania – Zanzibar |

15% |

VAT |

E-services |

100 million TZS |

Thailand |

7% |

VAT |

E-services |

1.8 million THB |

Turkey |

20% |

VAT |

E-services |

– |

Uganda |

18% |

VAT |

E-services |

– |

Ukraine |

20% |

VAT |

E-services |

1 million UAH |

United Arab Emirates |

5% |

VAT |

E-services |

– |

United Kingdom |

20% |

VAT |

E-services |

– |

Uruguay |

22% |

VAT |

E-services |

– |

Uzbekistan |

15% |

VAT |

E-services |

– |

Vietnam |

10% |

VAT |

E-services |

– |

Disclaimer

The information provided by Global VAT Compliance B.V. on this webpage is intended for general informational purposes only. Global VAT Compliance B.V. is not responsible for the accuracy of the information on these pages, and cannot be held liable for claims or losses deriving from the use of this information. If you wish to receive VAT related information please contact our experts at support@gvc.tax

Get in touch with one of our VAT experts