VAT ADVISORY SERVICES

Managing VAT compliance and other indirect taxes is a major concern for many companies operating cross-border. This is because nearly 150 countries across the globe have VAT, GST, or VAT-like regimes with local rules and regulations. Without a comprehensive plan and a deep understanding of the local requirements, non-compliance can be a substantial risk for the business.

Companies offer a wide range of services and products that meet clients’ needs all over the world. However, keeping track of local VAT obligations in each country where the business operates is challenging. Failure to understand how VAT works locally and a lack of attention to small details can lead to significant VAT exposures.

Tax authorities are getting more grip on company data on an international basis by sharing big data, making it very difficult for companies to escape being compliant.

GVC’s consultancy services are designed to assist your company in achieving and maintaining compliance within the jurisdiction of your choice, ensuring that your business remains informed of all the most recent advancements in VAT legislation.

VAT liabilities to consider

In recent years, tax authorities increased their focus on international businesses and are getting better at spotting VAT non-compliance by non-resident companies. Additionally, a lot of countries continue adopting new legislation to ensure the collection of VAT on e-commerce transactions. This creates a lot of uncertainty for companies and may result in the most frequent effects of being unaware of your VAT obligations such as:

- VAT assessments

- Interest and penalties

- In-depth audits

- Supply chain interruptions

How to manage VAT compliance?

It is a challenge to be VAT compliant in countries where a company does not have a presence, like e-commerce or digital service providers. The in-house tax team has to cover all these countries which require local expertise. Moreover, language barriers and unfamiliar legal systems can be another challenge. GVC can support you in those countries by bringing local expertise and VAT compliance solutions.

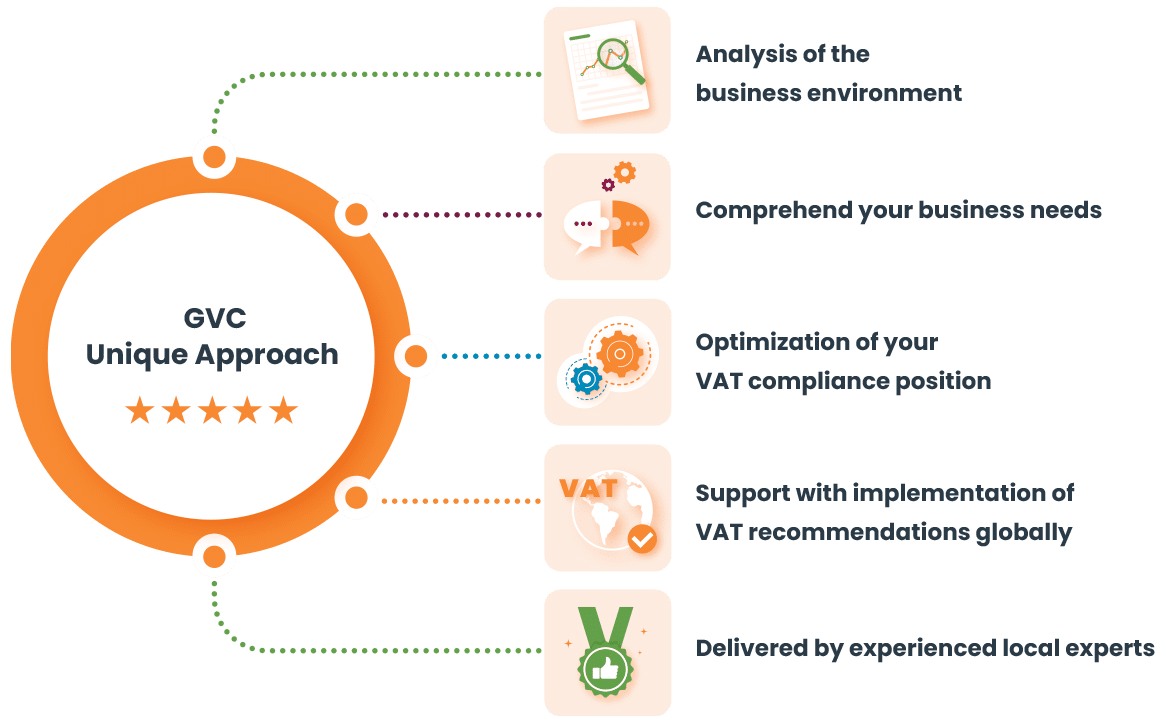

GVC’s Unique Approach

Global VAT Compliance stands out for its unique approach, which includes ensuring that the suggested VAT solutions will enable the organization to concentrate on expanding. Our VAT experts will evaluate the VAT procedures and your business model and advise you on how to optimize VAT compliance while at the same time reducing the risk.

Our VAT expert team speaks over 23 languages and has extensive experience in VAT consulting and compliance. We can produce a fast assessment of your VAT position and provide you with solutions.

Additionally, we can save you time by giving you the most recent information on a variety of VAT issues you might have. As a result, you will concentrate on growing your business.

GVC can answer all of your questions in a single VAT Consultation call with one of our specialists.

We offer premium VAT Advisory services for any type of business.

|

|

|

|

|

IOSSVAT Consultation |

VAT Consultation for Online Marketplaces & eCommerce |

VAT Advisory onDigital services |

VAT Advisory onCrypto assets |

GlobalVAT Advice |

Case Studies

Real-life examples of how we assisted our clients with VAT compliance

Case study 1

“Expanding business in Europe and the Asia-Pacific region”

One of our E-commerce clients offers online services and supply chain solutions to top brands in a variety of industries. Electronics, medical devices, consumer goods and other products and services are handled by the company. The client has VAT obligations in 35+ countries in Europe and Asia-Pacific countries.

We provided the company with specialized knowledge of how to support the expansion into new countries. At the same time, we made sure that the client meets all VAT compliance obligations. GVC still assists the firm with monitoring developments and providing advice.

Case study 2

“Global VAT Compliance delivered to the client a taxability matrix covering 46 countries.”

The client buys and resells telecom and web conference services from a global telecom provider in 46 countries.

To determine VAT obligations for digital services for B2B and/or B2C consumers, the company asked GVC to create a Global Taxability matrix for their services in these countries.

As a result, a VAT matrix and recommendations were provided to the client.

Case study 3

“VAT compliance implications related to a new Transfer Pricing policy”

A leading company in sports apparel decided to change their business model. This was reflected in a new Transfer pricing policy. The client asked for advice about the VAT implications. In the new policy, the transfer of risk related to transactions between the parent company and the subsidiaries was changed.

GVC examined the effects of VAT compliance responsibilities and provided support with the alignment between VAT and the new Transfer Pricing Policy.

Get in touch with our VAT Experts